Half-day Short Courses

Half-day Short Courses currently scheduled for July 29th, 2020

- Investor-Friendly

Financials: Most early-stage companies do not know how

to create and present the most relevant financial information to

investors in a way the investors will (1) quickly recognize, (2)

understand, and (3) have confidence that you will properly manage the

funds they invest. This short course describes the format and content

to be used in your investor data room documents that will convince the

investors they can trust you with their money.

- The Perfect Pitch? Or better?: Lots of folks teach

companies how to pitch to investors, each with their own different

version of the perfect pitch. In this course you will learn about the

most common approaches to pitching, and how to decide with method to

use for which audience, or perhaps how to create your own pitch for

your own company based on the audience and what you have to offer.

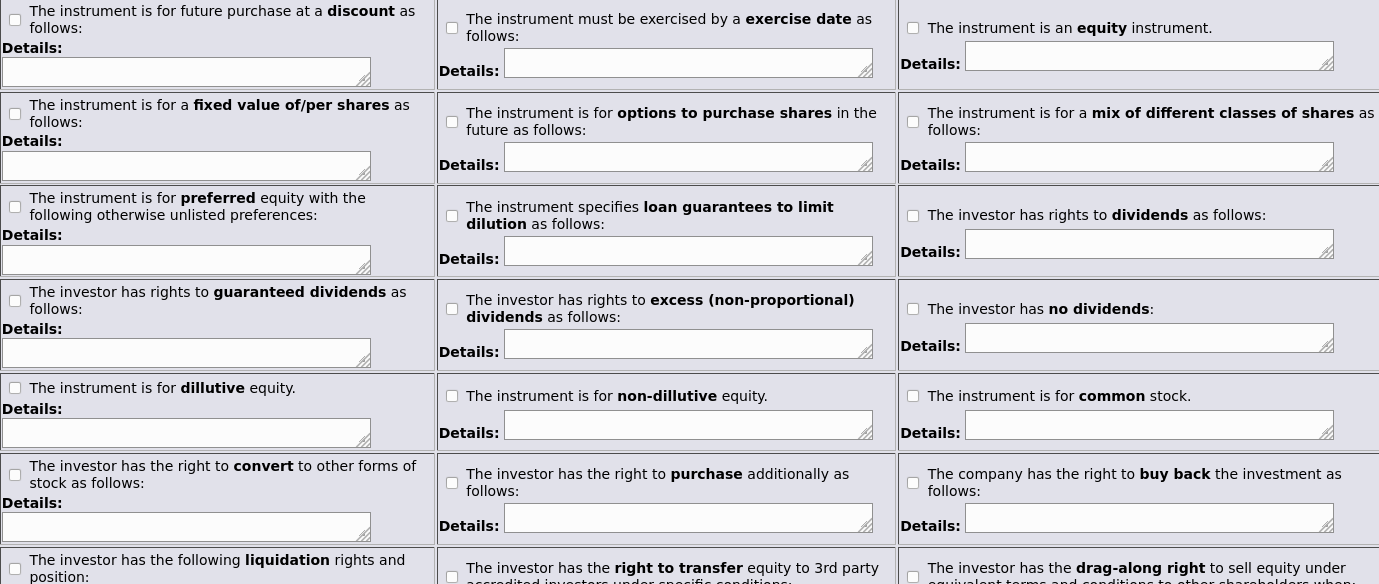

- Deal Terms and Valuations: Investment contracts contain a

wide range of deal terms, and the deal terms often have major effects

on the valuation in terms of what the sophisticated investor will

understand. In this course, we will go over many of the most common

deal terms, describe how they work, what they mean, and how the effect

valuations. Then we will discuss valuation methods and how they

interact with deal terms to close the investment (or not close it of

they are wrong)!

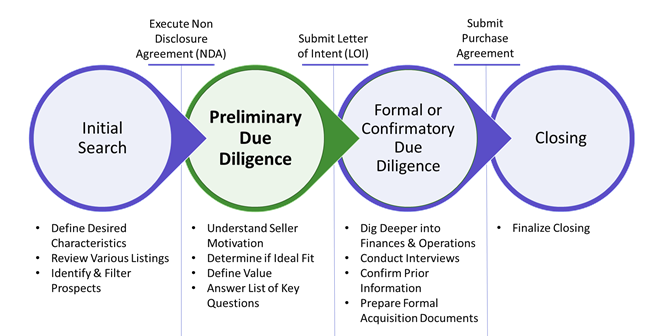

- Due Diligence - The easy

way: The due diligence process is usually a painful,

slow, expensive, and difficult method of assessing a company's

performance to date and growth potential in the future. It needlessly

delays, defeats, and/or misses many deals, both good and bad

ones. That's the hard way. In this short course, we discuss the easy

way to conduct due diligence -- with better results in less time and

with less effort. It's better for investors and better for the

companies they invest in.

AGENDA for July 29th Short Courses (All times US Pacific)

| Track | Times | Description | Sign up |

|---|

| Companies | 0800 - 1130 | Investor-Friendly Financials |

|

|---|

| Companies | 1330 - 1700 | The perfect pitch? Or better? |

|

|---|

| Investors | 0800 - 1130 | Deal Terms and Valuations |

|

|---|

| Investors | 1200 - 1530 | Due Diligence - The easy way! |

| |

|---|

Agenda for July 29th

Your Instructors:

- Fred Cohen: Fred hosts "Deal Terms and Valuations"

and "The perfect pitch? Or better?". He runs Angel to Exit, was the

founding President of the Pebble Beach chapter of Keiretsu Forum, has

invested in more than 50 early stage companies, is a partner in several

companies that helps early stage companies get funding, and has

worked with many other angels, advisors, and companies since the 1970s

(that's more than 40 years of experience at this). More on Dr. Cohen

can be found at fc0.co.

Course Details

Investor-Friendly Financials

Course outline:

- What do investors not like and like?

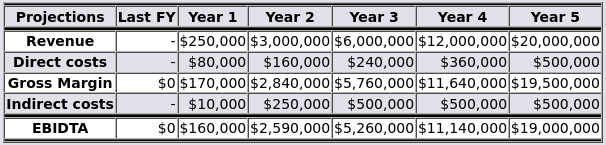

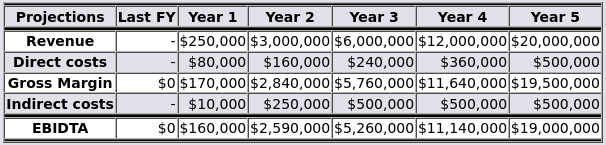

- Pro Forma Financial Statement Projections

- Fundraising Scenarios

- Business Model

- Revenue Streams

- Investment Request

- Financial Highlights

You will learn:

- Basics of Finance and Accounting for Entrepreneurs who are Fundraising

- How to Prepare and Present Financials for Internal Business Plan

- How to Prepare and Present Financials for External Investor Package

- Differences Between M&A Transactions (Strategic, Financial, Initial Public Offering)

- Revenue Stream ASP/Expense Bucket Distribution Methods

- Funding Amount (“The Ask”)/Type (Equity/Debt/Convertible Note)/Use of Funds Guidance

- Basic Understanding of Finance and Accounting for Entrepreneurs who are Fundraising

|

You will get:

- Investor-Friendly Financial Statements (Income Statements, Cash Flows, Balance Sheets)

- Financial Projection Trends (Revenue, Direct Costs, Gross Margin, Indirect Costs, EBITDA)

- Pre-Money/Post-Money Valuation Market Multiplier Indicators

- Investor ROI Estimates (Early/Middle/Late Exits)

- Guidance on Preparation of Financials for Internal Business Plan

- Guidance on Preparation of Financials for External Investor Package

|

The Perfect Pitch? Or better?

Course outline:

- What's in a pitch and why?

- 5 widely used pitch methods

- What the investor sees

- How to present yourself

- Horses for courses

- Build your new pitch

- Pitch times and content

- After the pitch

You will learn:

- Different ways to pitch to different audiences

- What to include and what not to include in your pitch

- Answers to specific questions about your pitch

- 20 tips on pitch delivery and timing

- 10 things NOT to do when you pitch

You will get:

- Outlines for different presentation approaches

- Techniques you are missing in your pitch

- Feedback on your quick pitch

- Access to our platform for pitch preparation

- Pointers on changes to your pitch to target it to specific investors

|

|

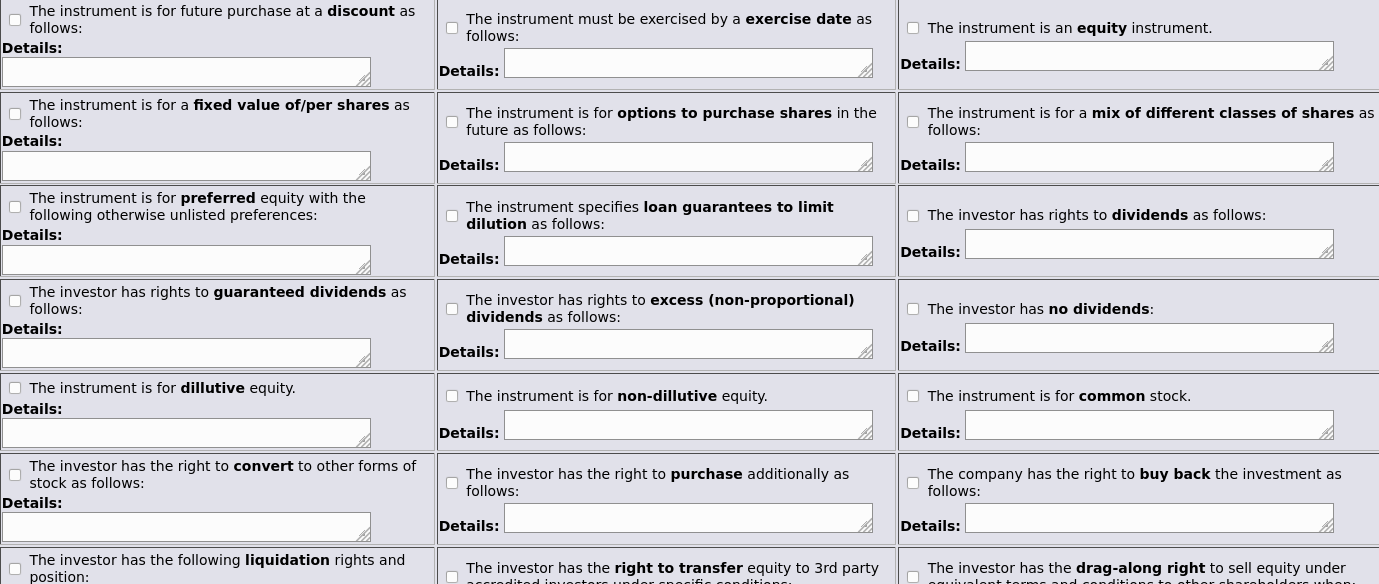

Deal Terms and Valuations

Course outline:

- 20 of the most common deal terms

- Deal terms investors hate

- Deal terms investors love

- The wacky wide world of notes

- 3 major valuation methods

- Valuation horses for courses

- Some simple calculation methods that work

- How deal terms interact with valuations

- Do you want a deal or not?

You will learn:

- What the investment agreeement is really offering

- What deal terms to avoid and why

- What deal terms to ask for and get

- Valuation methods that will tend to result in agreements

- Available options for trading valuations for deal terms

- How to structure a real deal that will hold up over time

- How dilution effects future outcomes

- How much of what will which investors tolerate

|

You will get:

- Sample deal terms

- Valuation calculation methods

- Access to our deal terms and valuation calculators

- Answers to questions about your deal terms

- Examples of deal terms that broke deals

|

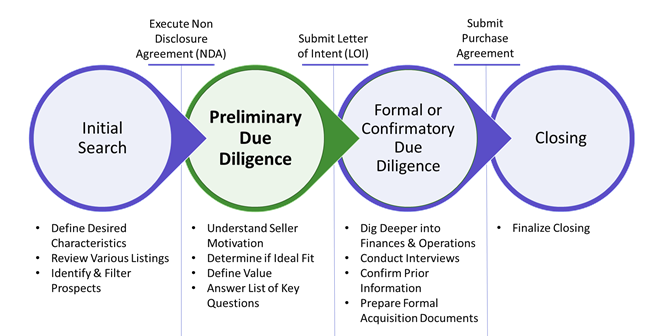

Due Diligence - The easy way!

Course outline:

- Business Excellence Framework

- Working Definitions

- Conducting Due Diligence

- The New Due

- Investor Data Room Documents for Due Diligence

You will learn:

- Basics of New Due Diligence Paradigm for Investors within Full M&A Transaction Life Cycle

- How to Define Key Performance Measurement Goals, Objectives, and KPIs

- How to Use Digital Scorecards for Measuring Performance to Date and Growth Potential

- Preliminary/Confirmatory Due Diligence Processes

|

You will get:

- Alignment & Assignment Matrix

- Enterprise Performance Model

- Functional Organizational Structure

- M&A Community Ecosystem Overview

- M&A Due Diligence Scorecard

- Sample Investor Data Room Structure

|

|