A Portfolio View of Investments

The Portfolio View

With the exception of individual investors doing investments for the first time, every investor has a portfolio of companies they have invested in, and as they invest more over time, that portfolio grows. Most such investors I have encountered, view these investments from a perspective of a portfolio, rather than as a set of independent individual investments.

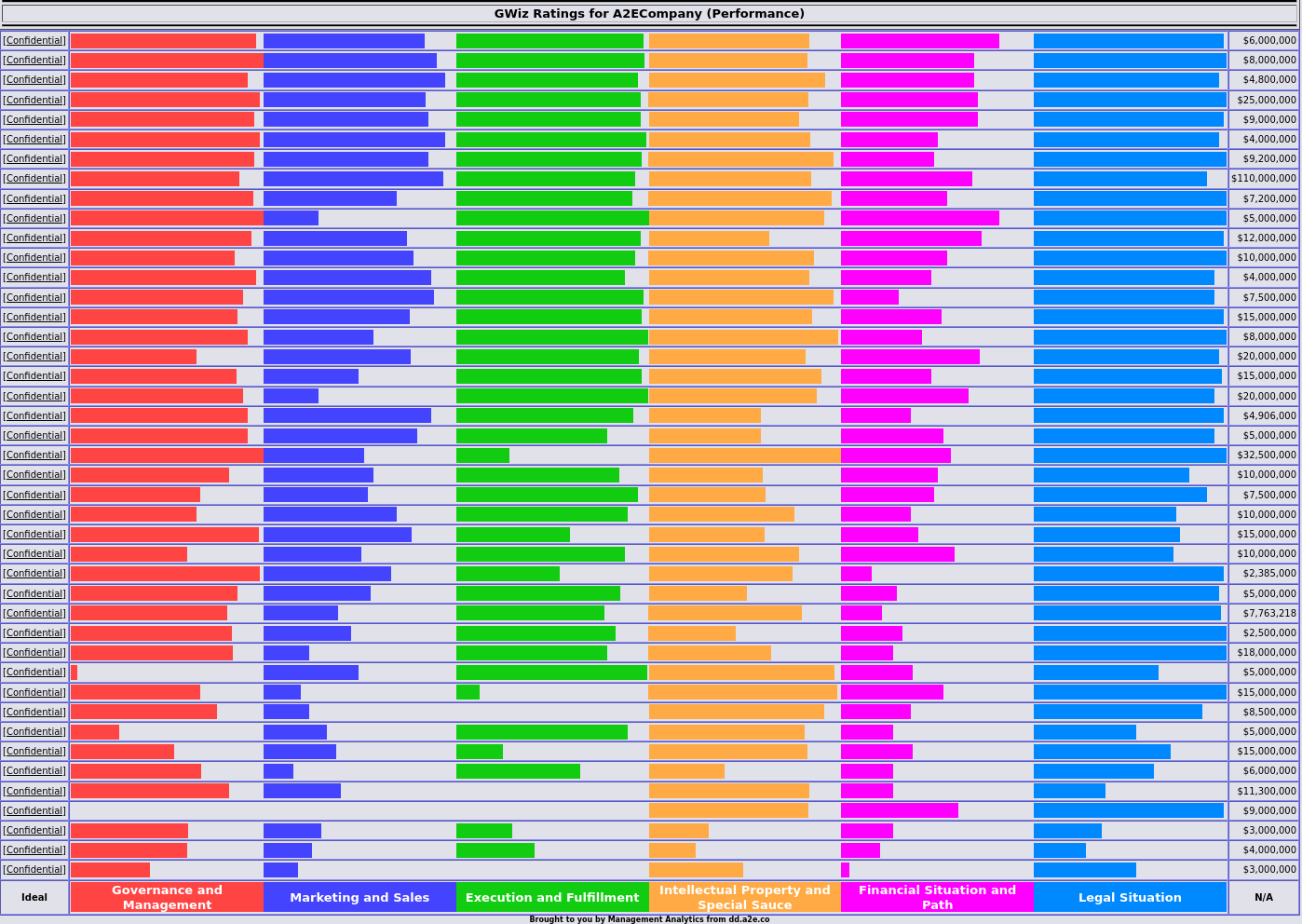

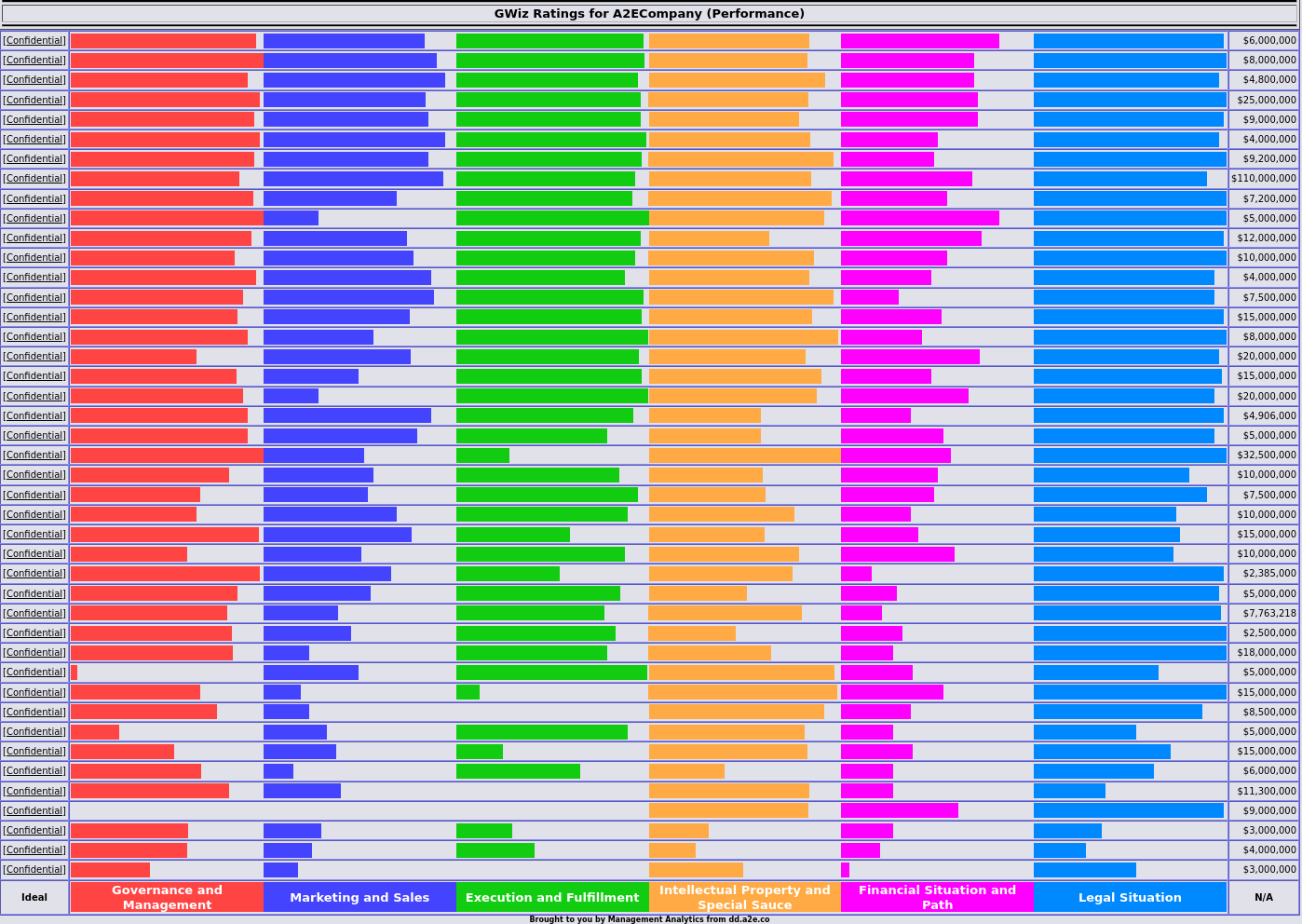

Here is an example of what a portfolio might look like when viewed sorted by quality but with valuations listed. I have anonymized it for obvious reasons.

Adding to your portfolio

Investments involve adding companies to a portfolio, and as a result, investments tend to be viewed in terms of the portfolio, rather than on their own. To get a sense of this, if I already have an investment in a company in a particular space, such as Ag Tech Greenhouses, depending on my "investment thesis", I may want to find other companies in that space that I can link up to my existing portfolio for synergistic benefits, or I may want to find companies that differ in every way from my previous investments for more diversity against failures in an entire industry.

My portfolio decisions are based on investing in opportunities with risk/reward tradeoffs at least as good as average angel group investments (expected 24% internal rate of return per year). That implies minimum growth rates over time, adequate total market size, adequate exit potential, and other minimums, but that is not enough to get you over the investment action threshold.

My next investment

Like many investors and investment groups, I make one investment at a time, closing one before going on to the next. As a result, I have, effectively, a list of the opportunities I am considering. Imagine them sorted by best to worst, with all listed companies meeting the minimum thresholds. That means any of them are eligible. But which one do I invest in?

Investments come when I have the money ready for investment and an opportunity ready for investing that money. At that time, I will look at the top few companies in my list, and use an analytical method (I use a tool called Decider) to pick the investment to make. Assuming the process goes smoothly, I will make that investment. Then I will remove that one from the prospect list and put it in the portfolio, and start looking at my next investment in the same way.

The portfolio review

I don't analyze the portfolio and my approach every day. Rather, I look at my approach and evaluation criteria, perhaps once a year, or when major changes happen. I looked after COVID became obviously important (February), and I look every quarter, but I don't typically make substantial changes in strategy. Rather, I might change the weightings of different aspects, which changes the order of priority, but not the list of above threshold candidate companies.

When I look, one of the things I look at is the balance across diversity requirements. For example, if I have too many life sciences companies and my diversity requires not being too heavily invested in any one part of the economy, I might degrade the weighting associated with that part (life sciences in this case). That doesn't mean I won't invest in another one, but rather, forces the opportunity to be all the better before I will make that investment.

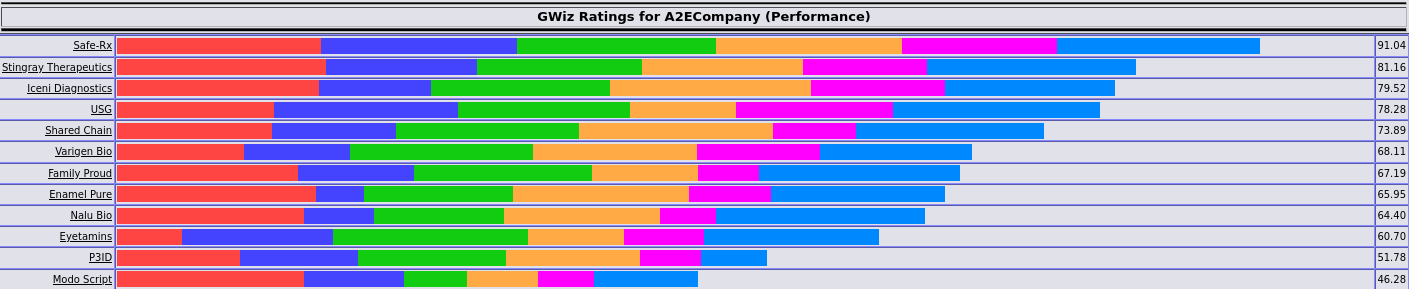

Similarly, when I look at putting a company into my portfolio, I look at how it "fits". For example, here is a slice of a hypothetical portfolio (the companies presenting this quarter so far, not an actual investment portfolio of mine):

Companies often think that the higher the number, the better the odds of my investment. But that is not true. It may mean that, if the information is well vetted, the companies higher on the list are closer to exit, but on the other hand, they are also likely to have a higher pre-money valuation, which means I get less per dollar invested. An angel investor might be more interested in adding a few earlier stage companies to their portfolio, the ones near the top representing early stage investments made long ago that are prospering. Perhaps I am only looking for companies I can help to improve, and that might mean companies below 65%.

On the other hand, if I had a bunch of companies below 50%, I might want to make some investments in companies far more likely to have good earlier exits. That might mean selecting my next few from those above 90% according to the metrics I am using at the time.

What this means to companies seeking investments

Better understanding of investors leads to better efficiency in seeking investments. Today, the market works like a job board, with companies applying to gobs of investment firms and investment firms sifting through perhaps 1,000 applicants to get to the 20 they are interested in and the 5 they invest in this year. By understanding the investor's perspective and spending the time to check out the investor's deal thesis and funding portfolio, you can save a lot of time and effort and have a better shot at getting the right investment at the right time from the right investor.

A call to action

Want to learn more about preparing for investment? The best next step is to:

We will help you understand investment opportunities and meet potential investors, prepare for investment, find alternative sources of funding, and better understand how investors will view your presentations and related material.

In summary

Understanding the portfolio views taken by investors will help to better understand how to get funded, who might be expected to fund you, and how they make their decisions.

Copyright(c) Fred Cohen, 2020 - All Rights Reserved