When I first saw the results

Measuring your company to help grow it

Many years ago, I started asking lots of diligence-related questions about my planned enterprises so I could understand how they worked and make sure there wasn't something important missing before starting down the path. It started this way:

I still start with those questions, and I find that people who are unable to answer them are likely in trouble in their business. And when I cannot answer those questions about my own business ideas, I don't go further until I can.

But then what?

These are a good starting point, but a lousy end-point. The problem is, of course, that once you figure these things out, and it may take a while, you may already be in a bad way because of all the other things you need to do to succeed.

In truth, I (and I presume you) are always figuring these things out. You (I presume) and I have to adapt these things forever in order to continue to succeed in business.

So given finite resources at any moment in time...

What should we focus on now?

At a tactical level, that's usually pretty easy. There is the urgent, and there is always something more urgent than something else.

But at the strategic level, there is the important. And figuring out what's more important is strategically very important. How do I do that?

If the very important thing is figuring out what's important, we may be in an infinite loop yielding...

The paralysis of analysis

I love that phrase. It is often used against the thoughtful folks by the smart, but less thoughtful, folks to indicate that the "academic approach" doesn't work here among those of us who have to work for a living.

And it is true that the more academically inclined among us have a tendency to argue in unlimited depth of detail about the number of angels that "fit" on a pin. For those interested, the remaining key argument at this time, after some thousand years of discourse on the question, is the meaning of the term "fit" in this context. Are they going to live there, or just try to pack themselves in like college kids in the 1950s in phone booths?

Metrics to figure out what's how important

Rather than going too far down that rat hole, I apparently tripped along the way and accidentally stumbled across a benefit of metrics that I was collecting anyway.

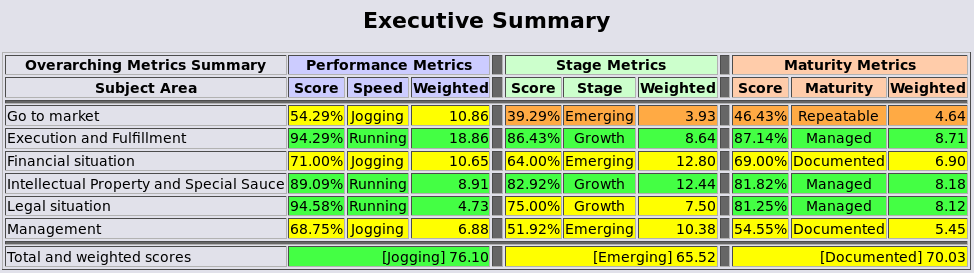

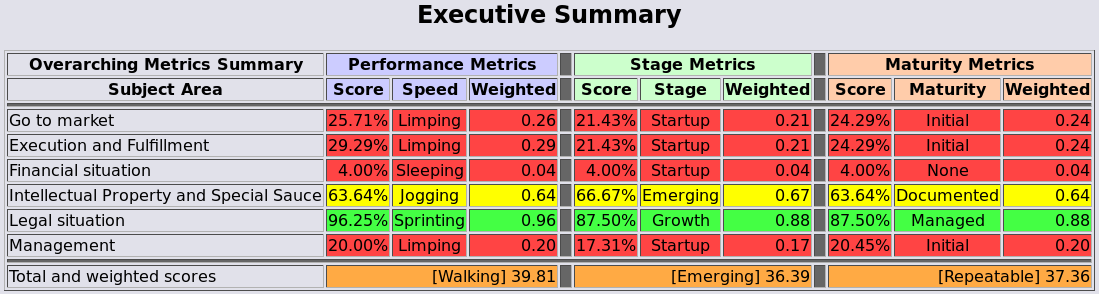

Before I started looking at metrics in new ways, I knew what we were doing but not how the different aspects of the business (shown above) stacked up. Once you see the picture, things become very clear very quickly. And by drilling down into the specifics of the measurements it became immediately apparent that we needed to up our game (in this case in sales training and channel partner support).

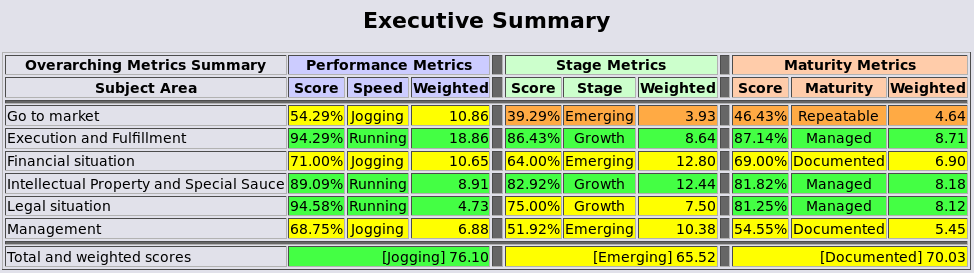

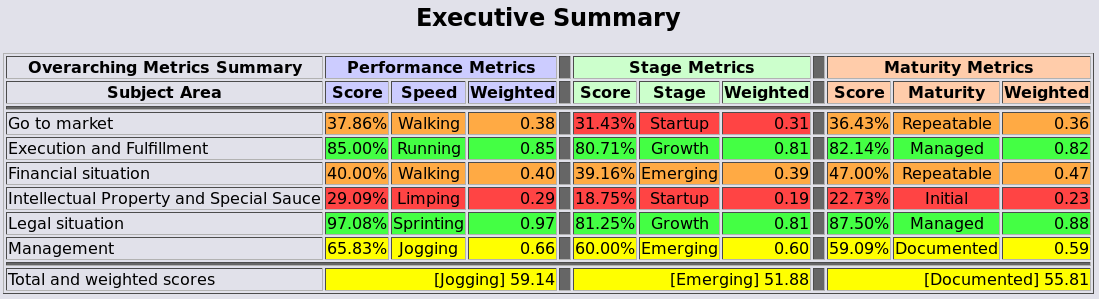

The net effect of figuring out what was important was to focus our efforts in the areas identified - not as weak or strong - but as limiting the performance relative to our stage and maturity. If we were in a different place, a different solution would have been in order. And that's the point of metrics in focusing strategic attention. In this case, it helped me identify where to focus efforts for a period of a month or two and it started to make a difference in that time frame. Here's what it looked like after the change:

Couldn't you do it without the tool and measurements?

I probably could have, and other companies probably do. But the simple reality is that until I developed and applied the metrics, I didn't identify or fix the issues that were holding this company back.

We are deploying the metrics within our existing client base, and it is starting to have significant effect. But we are measuring that over time...

Some obvious early results

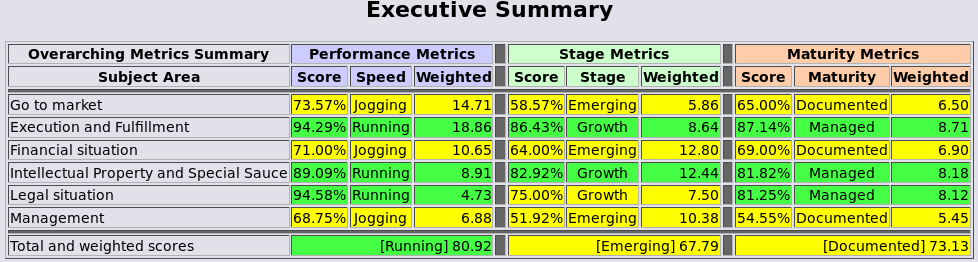

Here is an example of a company ready to take off. All they really need is financing. They are in the process of getting funding, and when they do, they will accelerate from their current situation of not enough cash to support inventory (they have more orders than they can fill) to an accelerating company growing by a factor of two or more per year, with a pretty big boost the first year above that.

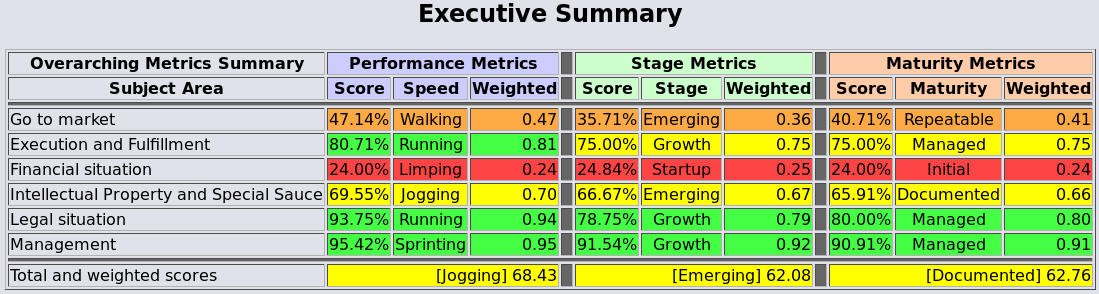

Here is an example of a real "startup". They have made some initial progress in a few key areas, but they would be unable to get funding, unable to make substantial sales, unable to fulfill if they had significant sales, and unable to manage growth if they were rapidly growing.

This next example is a company that is not yet at the knee point where it can accelerate, but approaching it. They are ready to operate, low on funds but able to continue, have inadequately secured intellectual property for the long run, or at least don't know what they really have, and need to focus on going to market so they can take off in a big way. As they start to accelerate, they will also need to secure their intellectual property situation or risk it all a few years later, and of course they will likely need money to grow as fast as they could grow, but perhaps could succeed without much more funding.

Do you really know all this from that?

I cheated a bit above. I know these companies a little bit beyond the display you see. I looked at the details of each area where the specifics are more clearly pointed out. If you looked at these things, and if you are experienced in understanding startups and investments in them, you would likely come to the same conclusions pretty quickly. Perhaps within 30 minutes.

I have independent validation for these particular results as well. These are the actual situations for these companies according to their advisory boards, and the information was provided by their CEOs. It took about 30 minutes for the CEOs to provide the inputs, 30 minutes or less for the evaluation, and we see where they are.

But what about the AI?

AI AI AI AI AI! (pronounced eye eye eye eye eye - an expression stated while lowering your head to where your chin meets your chest and slowly rotating it left to right). I prefer the term "natural stupidity".

Automated analysis, we have. And here is what it tells us (as an example):

This example is useful in that, when I first implemented it, it saved the few seconds required to come to these conclusions on my own and standardized the process. I no longer had to think about it. Not necessarily a good thing, but...

In order to validate the analysis program (not AI), I checked out the various companies already providing data. As usual, I learned that I am not as smart as I thought I was.

I found that I was surprised by some of the conclusions. Then I turned on the explanations, and after reviewing them, I decided that the analysis program was right. Since I wrote the program, that made me right, even though I was wrong when I tried doing it without the program. So it's OK to say that I was right even when I was wrong because I was right to write the program that showed that I was wrong.

Naturally, I added more automated analysis (creeping featurism). I had already implemented metrics on improvement and done manual review of areas of improvement with the greatest incremental effect on the performance of the business. The data was there, so I automated that analysis. So now, instead of doing it manually (and making mistakes some of the time), the analysis provides a sorted rated listing of which issue in which section of the metrics produces the greatest overall improvement if stepped up one notch on the scale. This is sometimes called variation of parameters, but I don't want to be held to such a high-sounding standard.

And of course, as you can guess, I surprised myself again... OK - not really. In this case I already knew what would happen. The analysis is simply there to save time and effort, and reduce the required information and in-your head error-prone analysis for the user. Instead of looking at 40 different items individually and trying to put the numbers together, it just shows up in a sorted table in one place. Merely a labor saving device.

Where's the magic in that?

The real magic in the automated analysis (not AI) is two-fold, as it is in most such analysis:

The first benefit is consistency in volume without as many errors. Forget the surprises, this is just a side effect of not thinking as completely about the same issues that you automate. The surprise, once you see the basis for the analysis, comes from noticing that you hadn't thought of the thing you wrote the program to analyze in every case where you looked at a company. People are just not as fast or consistent at repeated data processing as computers.

The second benefit is that in automating the analysis, you don't have to show and see all the details in order to get the answer. Put another way, it looks like magic, but it's really just jumping to the answer without showing all your work. The benefits come in several ways.

The magic effect brings more interest to the user than the details of additions, subtractions, multiplications, divisions, and conditionals. Watching how a program operates for this sort of stuff is less exciting than watching grass grow in slow motion.

By the time you look at all that stuff, you actually miss the result. It's an experimentally validated cognitive reality that presenting excess information produces errors of omission. It also looks too busy even for my tastes, and I like dense presentations.

The special sauce is the analysis itself, so you can keep it a secret while providing the benefit to the user and still being able to validate results for authorized users in drill-downs. So instead of telling everyone all about how I do it (I used to do this in peer reviewed articles) and seeking a patent (5 years later for gobs of money and without the ability to enforce it because of court rulings), I keep it a trade secret and only make it available to people with trade secret agreements in place.

Different information is also useful for different people. The details of internal operational mechanisms are useful for programmers debugging the code. The details of what to emphasize for clients is useful for analysts who clients pay to do the analysis and use their judgment. The output presenting the input in summary forms (what you see above in the images) is useful to the CEO to understand their situation in a more simplified form.

The different presentations support different business models. For example, a consulting practice (like ours) uses the internal information along with our expertise and judgment to help clients make better decisions (than they might without the same information and assistance). But the same information can be made available to sophisticated investment groups as volume content for use in their automated analysis (not AI) of business patterns associated with their investment portfolios.

And of course, everyone enjoys a little magic show now and then...

The pace of change

The next step for this methodology will be tracking over time. The tool provides the ability to do this, but the rate of change is not likely to be all that rapid. Knowing that you need investment is not the same as getting it. Knowing that you need to build up your sales and marketing is not the same as building it up. As a guess, updating these metrics quarterly would be about right for showing progress against objectives.

For example, investors with a portfolio would likely want to set specific tactical goals (e.g., financial: some dollar improvement in sales, legal: some regulatory hurdle passed, etc.) and strategic goals (e.g., make significant progress toward the knee point in one quarter, ready to accelerate in the second quarter, clear acceleration in the 3rd quarter) and get quarterly updates as a basis for release of the next tranch of funds.

In many cases, it only takes a few small improvement to move up the scale a notch. The company near the knee point could and likely will move up a notch in one or two areas in the next 3 months, and up another notch in a few other areas in 6 months. At that point, they will start to accelerate. But the higher you get, the harder it is to move up. So I would expect their strategic results to improve over the next 6 months to the acceleration point. If financing can arrive in time, they should be able to rapidly accelerate in the following 6 months, improving a notch in a few more places, and up from there.

A call to action

Part of the improvement in my go-to-market is making sure I provide you with the opportunity to buy something. If you are an investor interested in applying these metrics to your investments:

Accredited investors: |

If you are a company interested in using these metrics to help you grow:

In summary

I managed to do it again. Learn more about something I thought I already knew about by stumbling into it. And yet, when you stumble up the stairs, it's a lot better than stumbling down them.

I encourage you to find and adopt some useful metrics for your company to understand how to make better strategic decisions.

Copyright(c) Fred Cohen, 2019 - All Rights Reserved